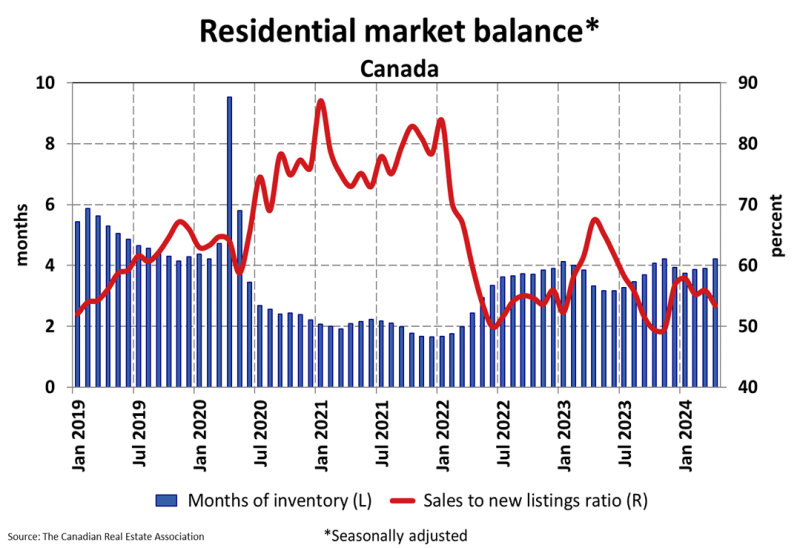

Slower seasonal sales helped build inventory to its highest level since September 2019 in the Fraser Valley real estate market. The higher levels of inventory we are seeing have shifted the region towards more of a balanced market.

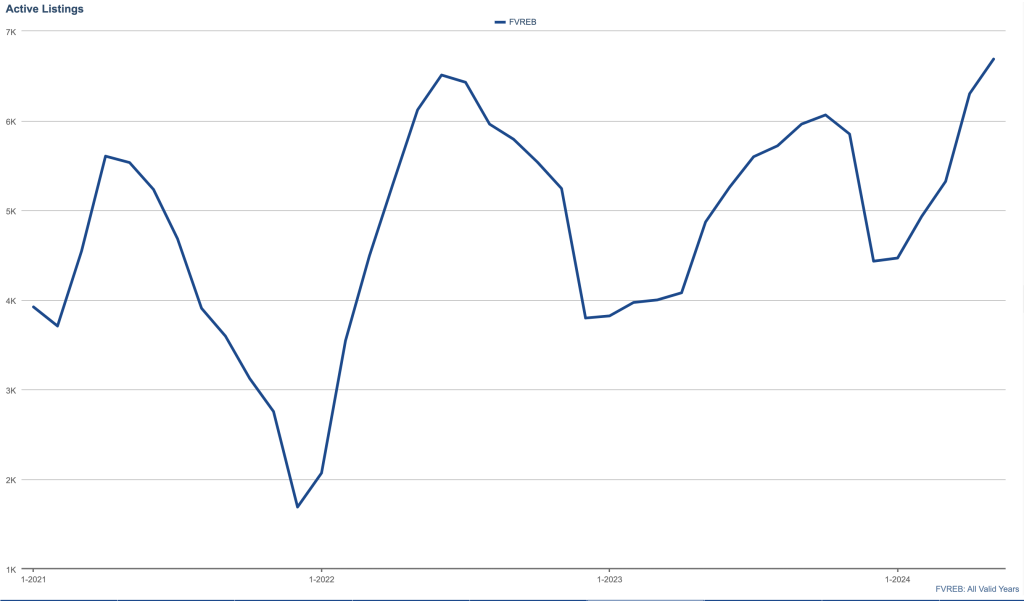

Fraser Valley Real Estate Active Listings

The biggest trend we are seeing in the Fraser Valley real estate market is the accumulation of active listings. Active listings are up 42% over May 2023 and 19% above the 10-year average. Growing inventory levels are helping to create a healthy balance in the market, giving buyers more options, especially as prices continue to flatten.

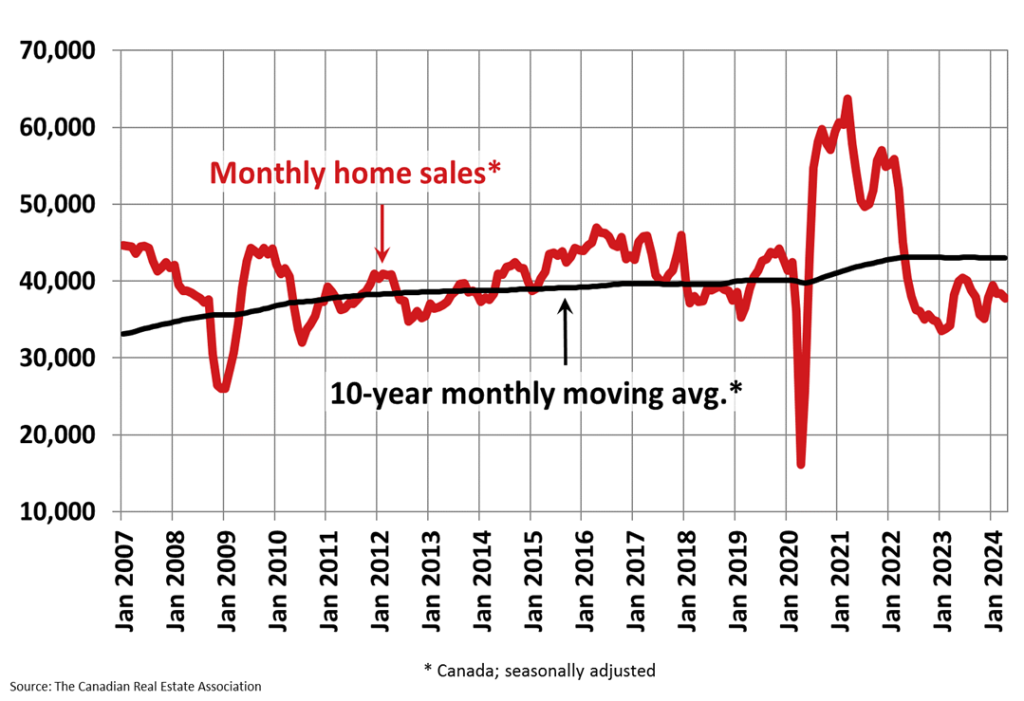

Sales

Sales remained seasonally slow. May sales were 21% below the 10-year average, which is rare for this time of the year. Remember that April and May typically see the highest sales volume in a calendar year.

Looking at sales in all of Canada, we are still below the 10-year average and have been since the spring of 2022.

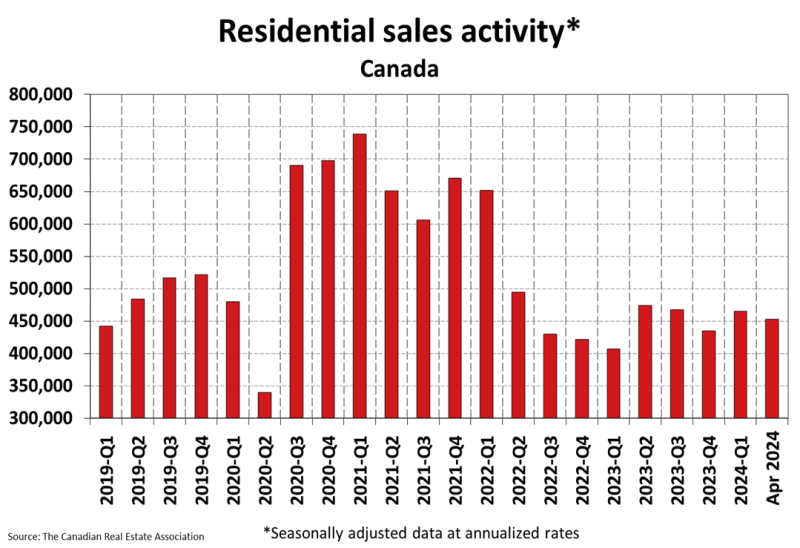

The graph below does a good job of showing how low sales have been in Q2 (the Spring market) this year compared to other Q2’s, except Q2 in 2020 (Covid).

Average Sale Prices: Canada, All Property Types Combined

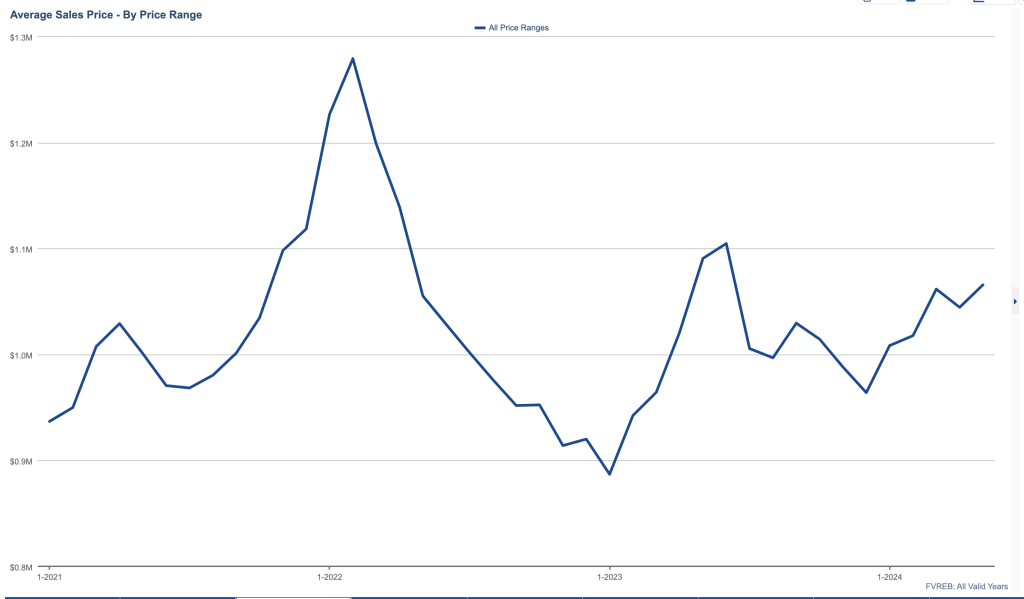

Average Sale Prices: Fraser Valley Real Estate, All Property Types Combined

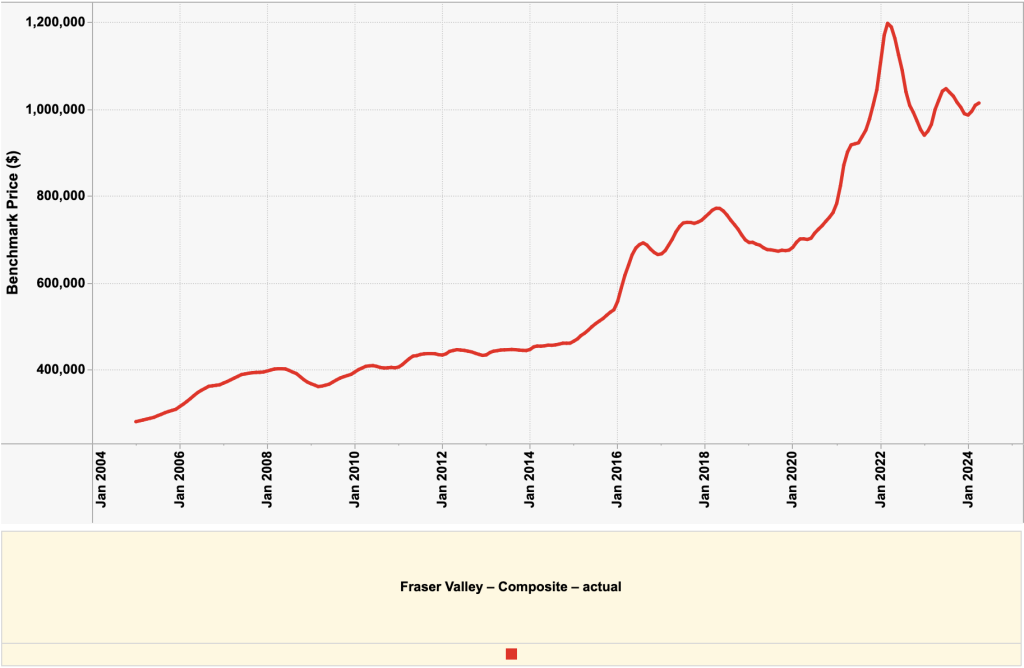

Looking above and comparing Canada to the Fraser Valley real estate market, we see both follow a similar trend. Prices have overall been on an upward trend in 2024. It will be interesting to see how the summer plays out. As usual during the summer months, sales typically decrease as most people are on summer vacations and not in their regular routines. Factoring in the higher-than-usual active listings we have coming to market, and the expectations of slower sales volume ahead, we could very well be headed toward a buyer’s market.

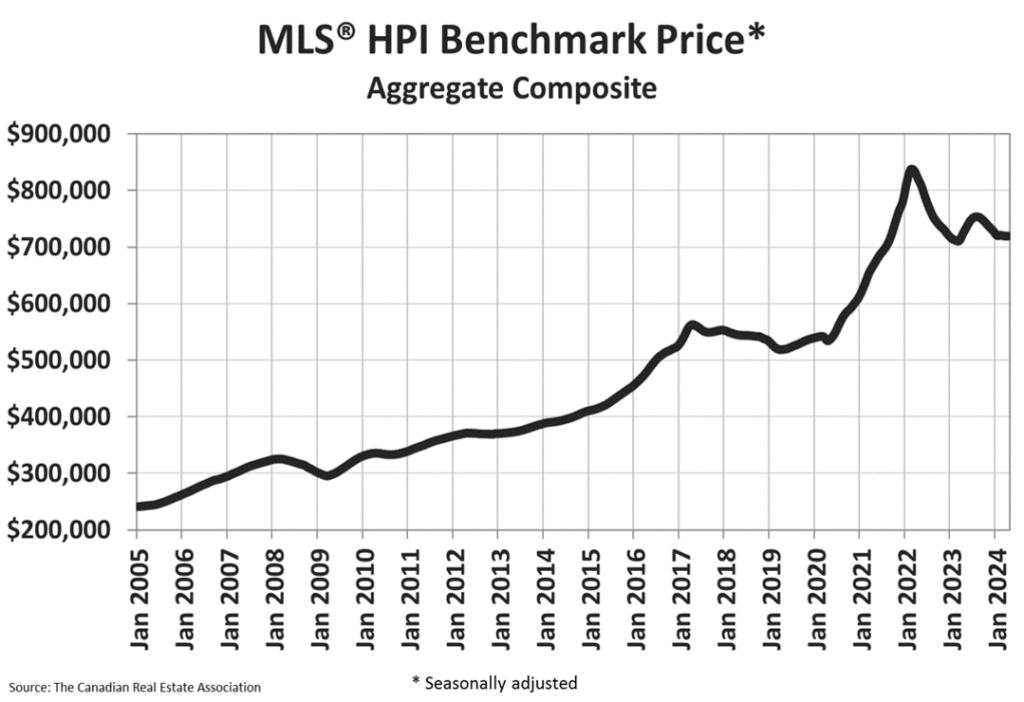

Benchmark Price, Canada, All Property Types

Benchmark Price, Fraser Valley Real Estate, All Property Types

Bank of Canada Interest Rate

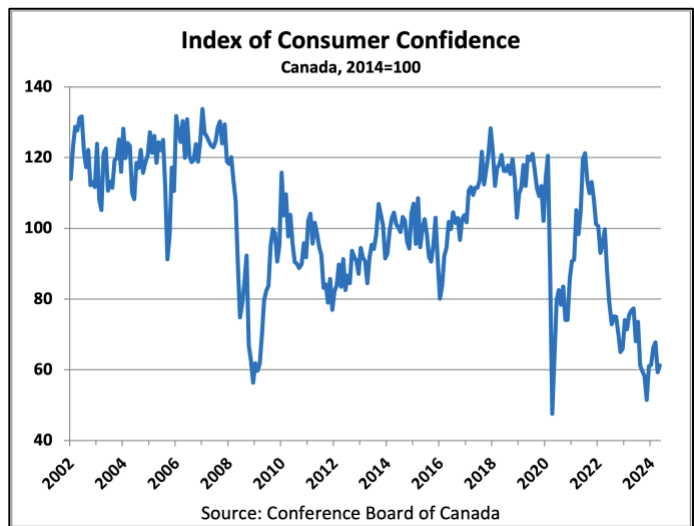

After 10 months of steady holding at their peak policy rates, the Bank of Canada has cut them by 0.25% as of June 5, 2024. This marks the first step in what is expected to be a series of rate reductions by the central bank as they aim for a “soft landing” for the economy. There are four more meetings scheduled this year. These may result in additional rate cuts if the data trends cooperate, and the trend is expected to continue until the end of 2025.

Despite the 0.25% rate decrease I am still seeing Buyers being cautious when searching for their next home. 0.25% of cuts does not really move the needle on the affordability or debt servicing side. It may however lead to an increase in consumer confidence down the road. I believe that we are in for steady declines over the next year, and that as that happens more and more buyers will get back into the market.

Market Type, Canada

Market Type, Fraser Valley

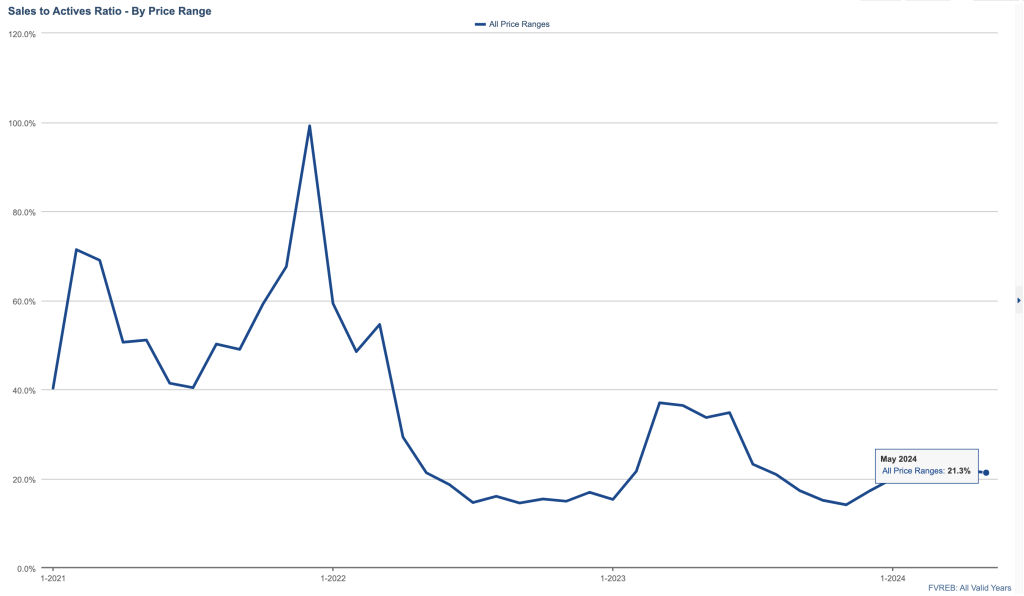

With a sales-to-active listings ratio of 21% for all property types, the overall market conditions in the Fraser Valley real estate market are balanced.

Click here to see my active listings.